Indicators on Succentrix Business Advisors You Should Know

Indicators on Succentrix Business Advisors You Should Know

Blog Article

Not known Facts About Succentrix Business Advisors

Table of ContentsTop Guidelines Of Succentrix Business AdvisorsSome Known Factual Statements About Succentrix Business Advisors Facts About Succentrix Business Advisors RevealedThings about Succentrix Business AdvisorsSuccentrix Business Advisors Things To Know Before You Get This

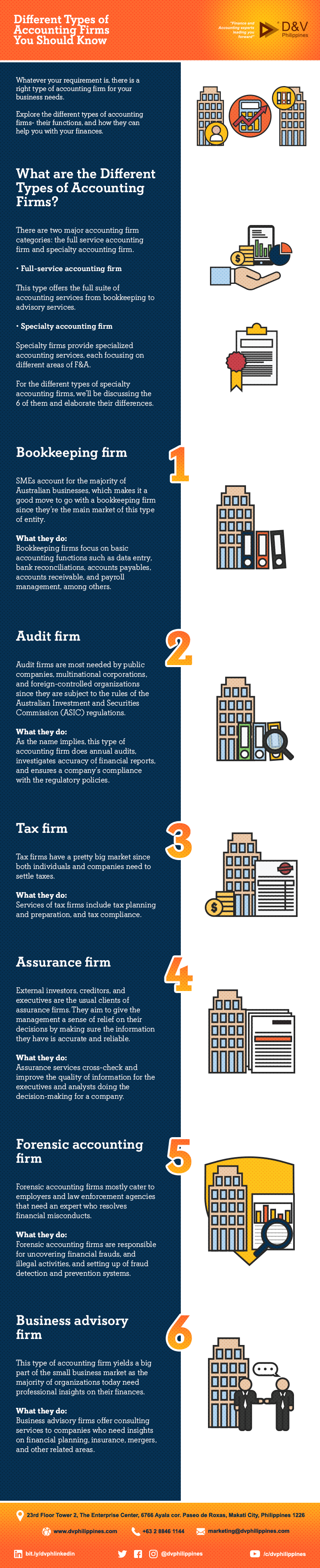

Getty Images/ sturti Outsourcing audit services can liberate your time, protect against mistakes and even reduce your tax costs. However the excessive variety of services might leave you frustrated. Do you require an accountant or a state-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT)? Or, perhaps you wish to manage your basic accountancy tasks, like balance dues, yet hire a specialist for capital projecting.Discover the different kinds of accountancy services available and find out how to choose the best one for your little service demands. Audit services fall under basic or monetary bookkeeping. General audit refers to regular duties, such as videotaping deals, whereas financial audit strategies for future growth. You can work with a bookkeeper to enter information and run reports or deal with a CPA that offers economic suggestions.

They may likewise reconcile banking declarations and document payments. Prepare and submit income tax return, make quarterly tax repayments, data expansions and handle internal revenue service audits. tax advisory services. Tiny organization owners additionally evaluate their tax problem and stay abreast of upcoming modifications to avoid paying even more than required. Produce economic declarations, consisting of the annual report, earnings and loss (P&L), capital, and earnings statements.

Succentrix Business Advisors - Truths

Accounting solutions may additionally consist of making payroll tax settlements., offer economic planning suggestions and clarify economic statements.

Often, small organization proprietors contract out tax services first and add pay-roll assistance as their business expands., 68% of respondents make use of an exterior tax obligation practitioner or accountant to prepare their firm's tax obligations.

Develop a listing of processes and duties, and highlight those that you're eager to contract out. Next, it's time to locate the best audit company (Accounting Franchise). Since you have a concept of what kind of accounting solutions you require, the inquiry is, who should you employ to give them? While an accountant handles data entrance, a CPA can talk on your part to the IRS and provide economic guidance.

Indicators on Succentrix Business Advisors You Should Know

Prior to choosing, think about these concerns: Do you want a regional accountancy expert, or are you comfortable functioning basically? Should your outsourced services integrate with existing audit devices? Do you require a mobile application or online site to manage your accountancy services?

Brought to you by Let's Make Tea Breaks Happen! Request a Pure Fallen Leave Tea Break Give The Pure Fallen Leave Tea Break Grants Program for small companies and 501( c)( 3) nonprofits is now open! Obtain a chance to money ideas that resource foster healthier workplace culture and standards! Concepts can be brand-new or already underway, can come from HR, C-level, or the frontline- as long as they boost employee well-being with society modification.

Something failed. Wait a moment and try again Attempt once more.

Advisors provide beneficial insights right into tax techniques, making sure organizations lessen tax obligation liabilities while adhering to complicated tax obligation policies. Tax obligation planning includes positive steps to optimize a business's tax obligation setting, such as reductions, credit reports, and motivations. Staying on par with ever-evolving accounting requirements and regulative requirements is vital for services. Bookkeeping Advisory experts aid in economic coverage, making sure accurate and certified monetary statements.

Examine This Report on Succentrix Business Advisors

Right here's an in-depth consider these crucial abilities: Analytical abilities is an essential skill of Accounting Advisory Services. You need to be proficient in gathering and assessing financial information, drawing purposeful insights, and making data-driven referrals. These skills will enable you to assess economic efficiency, identify trends, and offer informed advice to your customers.

Interacting properly to clients is a vital skill every accountant ought to have. You should have the ability to convey complicated financial information and insights to clients and stakeholders in a clear, understandable way. This consists of the ability to equate economic jargon into simple language, create detailed records, and deliver impactful presentations.

The Greatest Guide To Succentrix Business Advisors

Accountancy Advisory companies make use of modeling strategies to simulate various financial scenarios, evaluate prospective results, and support decision-making. Efficiency in monetary modeling is crucial for exact projecting and critical preparation. As an audit advising company you must be well-versed in economic laws, audit criteria, and tax obligation laws relevant to your customers' markets.

Report this page